Optimize working capital - finance growth

Working capital is needed as much as necessary and as little as possible. A simple principle, really, but its implementation has never been more complex than it is today. Interest rate hikes, disruption of global supply chains, rising prices and growing uncertainties are currently presenting working capital management with enormous challenges. Since 2021/22, many SMEs have again shown high sales growth, but are struggling with bottlenecks in financing this growth, especially against the background of the mostly significantly higher inventories required and the currently rising interest expenses.

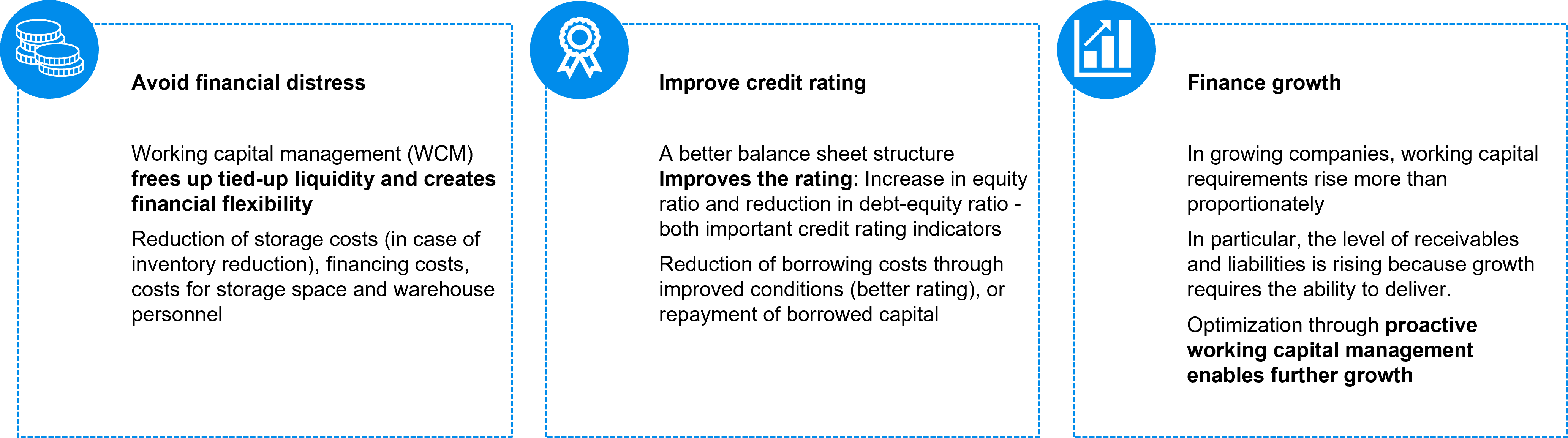

Regardless of the starting position, active working capital management improves profitability and thus the value of the company - and at the same time increases resilience

Working capital management as a strategic corporate task

Today, more than ever, effective control and monitoring of working capital is once again one of the key strategic corporate objectives. A corresponding reduction in working capital is an essential building block for creating financing scope and thus investing in further growth.

It is therefore hardly surprising that more and more companies are once again focusing on active working capital management. Irrespective of the initial situation, it improves liquidity and profitability and thus increases the value of the company as well as its resilience!

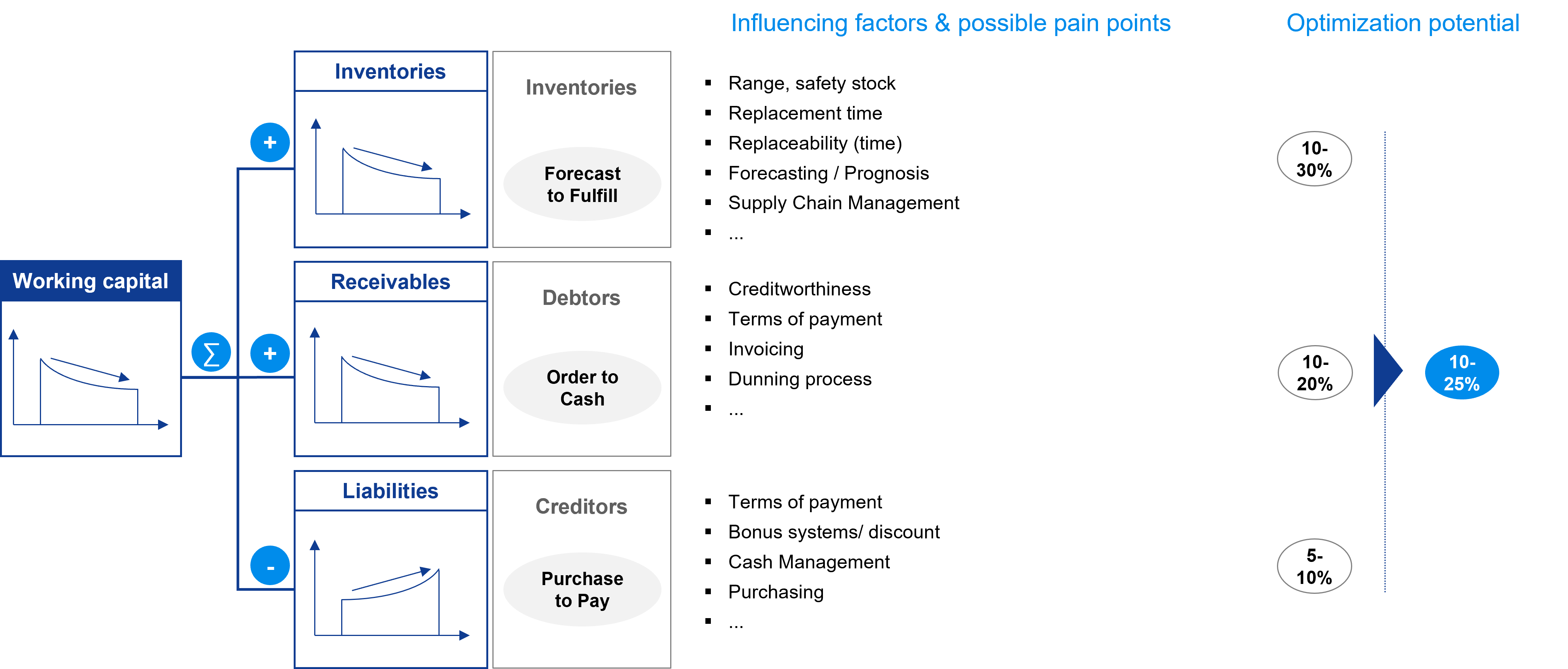

Measures to optimize working capital have been initiated in many companies in isolated cases. Examples are the adjustment or sale of old inventories, the increase of supplier payment targets, and so on. Nevertheless, most companies are not even aware of the liquidity reserves that can be mobilized through holistic working capital management. In addition, they often lack the right approach for effective control.

The key to successful working capital management lies in cross-organizational transparency and the elimination of disruptive factors in processes along the entire value chain. In addition, the product and customer strategy as well as the corresponding sales and supply chain strategies must be analyzed and adjusted if necessary.

Success factors for effective working capital management

1. Process and digitization know-how

In many cases, there is a lack of a corresponding holistic approach to identifying the key optimization levers. Such a holistic approach to identifying and evaluating optimization levers combines the end-to-end view in the Purchase to Pay, Forecast to Fill and Order to Cash processes with the specific requirements of the business model. Supported by quantitative analyses, disturbance variables become transparent. This ensures the sustainability of the measures derived. The analyses and measures often result in further starting points for improving performance, for example when the transparency of payment conditions is used for adjustments in discounting or transport costs can be reduced by bundling.

2. Bundling specialist expertise

The expertise of the finance, sales, purchasing and production/operations departments, including materials management, should be bundled - purely top-down approaches at management level, which are frequently encountered, do not go far enough. If necessary, technical expertise may even be required to adapt the product design (common parts strategy, etc.). The focused use of consultancies with the appropriate know-how can also provide quantitative and qualitative support. However, in the longer term, the focus here is on empowering the company to be able to handle this ongoing task of working capital optimization on its own and repeatedly. A structured approach adapted to the company's business model across the entire value chain is absolutely critical to success.

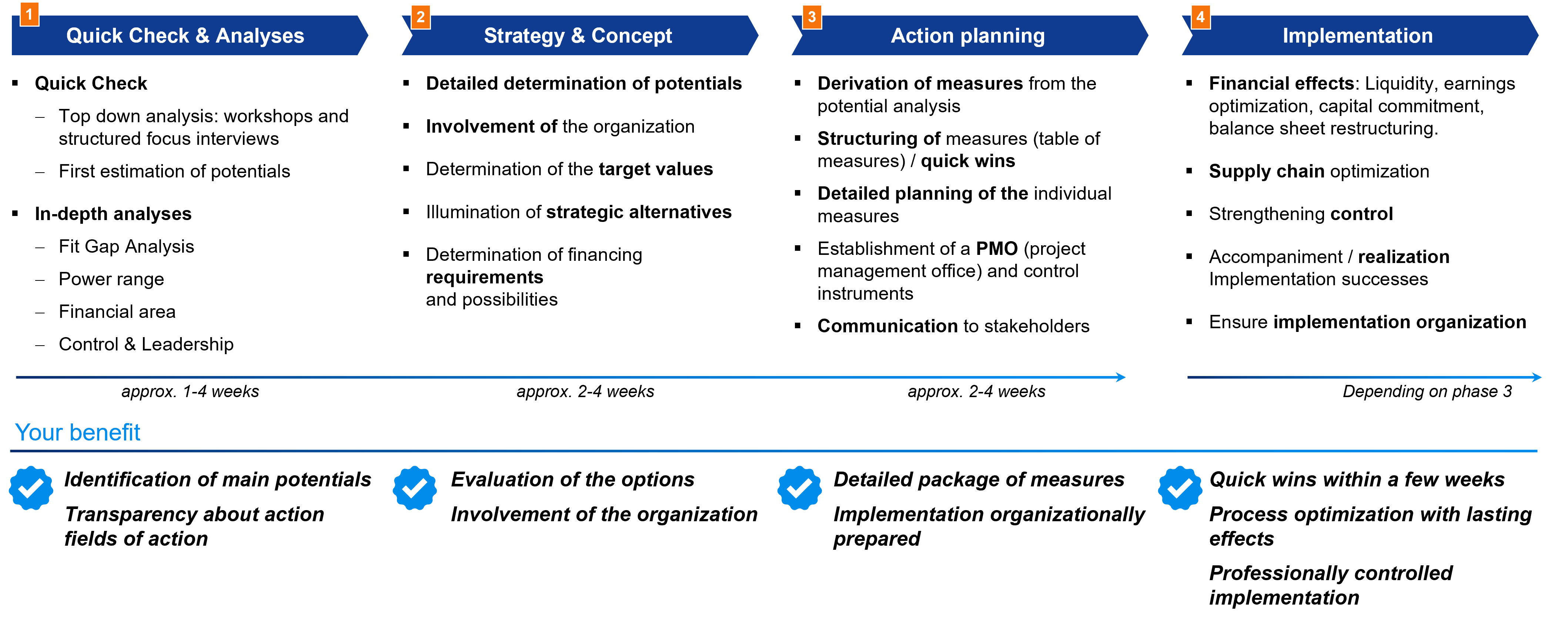

3. Define implementation program and roadmap

Concrete contents and milestones of a program of measures are to be determined within the framework of interdisciplinary management meetings. The contents of the measures are to be detailed with the future responsible persons down to the activity level in the form of profiles. Already here, the measurability of the goals must be ensured. The success of implementation is based on a suitable project organization with a project management office and appropriate communication tools.

4. Cash is king - focus on liquidity and set measurable targets

The focus on liquidity in business processes often requires a real cultural change among process owners in addition to sustained management attention. The goal throughout the organization must be to achieve a best practice level in working capital management with corresponding continuous improvement processes. In addition to process optimization expertise, this also requires effective steps toward digitization throughout the value chain: from automated invoice generation and posting in the finance area to AI-based forecasting in the production process to optimize safety stocks, among other things.

Our proven approach

We analyze in a focused manner, in comprehensible steps with proven tools. In addition, we empower your employees and spare your capacities.

Summary

Current increases in financing costs and financing requirements are once again bringing the optimization of working capital to the fore. This is not just about a simple reduction, but a differentiated consideration of liquidity and delivery capability as well as other customer requirements. Quick wins are often easy to implement and a suitable first step to focus on liquidity and to anchor continuous optimization as a goal in working capital management.